Following the Money: A Detailed Breakdown of How American Tax Dollars Are Spent

Every year, American taxpayers contribute significant portions of their hard-earned money to federal, state, and local governments. It seems that no matter how much we earn or how far we progress, our taxes only seem to become more burdensome. But where does all the money go? How is it spent? What are we getting for our money? This is precisely what this article aims to uncover by showing how this money is allocated and spent/ This comprehensive analysis aims to demystify the complex process of government spending and show taxpayers exactly where their money goes.

This article is brought to you by the Middle Class Party, dedicated to building a unified America through practical solutions and shared commitment. Our mission is clear: to bridge societal divides and empower the backbone of our nation—everyday Americans. This piece seeks to highlight the perilous state of the America we hold dear, now at risk of slipping into obscurity. It underscores the urgent need for the middle class to come together and champion common-sense economic reforms that will enhance the well-being of our country.

Middle Class Income and Taxes

The Pew Research Center defines the middle class as individuals earning between two-thirds and double the median U.S. household income. According to the U.S. Census Bureau, the median household income in 2021 was $70,784. Based on these figures, a middle-class income would range from approximately $47,190 to $141,568.

According to SmartAsset, federal tax brackets are what significantly influence personal finances. There are seven different brackets. The brackets range from a low of 10% to a high of 37%. If you're part of the middle class, you likely fall into the 22%, 24%, or possibly 32% brackets. While it might seem like you're paying a flat percentage of your income based on your bracket, that's not actually the case.

Income is taxed progressively, meaning the first portion is taxed at 10%, the next at 12%, and so on up to your respective bracket. This method ensures that only the income within each bracket is taxed at the higher rate. This structure, where tax rates increase with income, characterizes a progressive tax system. Meanwhile, state tax systems can vary: some states also use progressive rates, while others apply a flat tax rate across all income levels.

Government Revenue

The primary sources of revenue for the U.S. government include individual and corporate taxes, along with dedicated taxes for Social Security and Medicare. These funds are utilized to support a broad range of services, programs, and goods that benefit the American public, as well as to cover interest on borrowed money. Additionally, government revenue is bolstered by customs duties, leases of government-owned properties, sales of natural resources, various fees for usage and licensing, and payments to federal agencies such as the U.S. Department of the Interior. In 2023, total government revenue amounted to $4.44 trillion.

Government Spending

The federal budget is structured into roughly 20 categories, known as budget functions, which organize federal expenditures by their specific purposes. The data below, provided by the Treasury Department, shows the top 10 categories and agencies for federal spending in Fiscal Year 2024.

Social Security-22 %, $715 Billion.

Health-14 %, $449 Billion.

National Defense-13 %. $433 Billion.Net

Interest-13 %, $429 Billion.

Medicare-12 %. $391 Billion.

Income Security-11 % $356 Billion.

Veterans Benefits and Services-5 %, $152 Billion.

Education, Training, Employment, and Social Services-3 %,$99 Billion.

Other-3 %, $105 Billion.

Commerce and Housing Credit-2 %, $65 Billion.

Transportation-2 %, $60 Billion.

Total government spending in 2023 totalled $6.13 trillion, leaving a deficit of $1.70 trillion in 2023.

Why Everything Is So Expensive in 2024

As Americans recovered from the coronavirus pandemic lockdowns with pent-up savings and a readiness to spend, inflation emerged as a significant threat to both household finances and the broader economy for the first time since the 1980s. Since February 2020, when the outbreak-induced recession began, prices have increased by 20.4 percent, according to the National Bureau of Economic Research. This price surge means that goods and services that once cost $1,000 now require approximately $1,200. This affects everything from our savings to our ability to deal with financial emergencies.

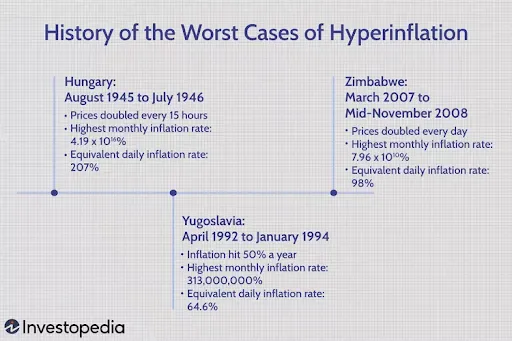

And if inflation isn’t properly dealt with, it could spiral out of control and turn into hyperinflation, a rapid, massive, and unmanageable increase in prices. Looking at history, this could become a serious problem.

Hyperinflation

In ancient Rome, the primary currency was the silver coin known as the Denarius. The finite supply of silver and other precious metals within the Empire naturally limited the amount of economic activity, as it was tethered to the number of Denarii in circulation. To circumvent this limitation, Roman emperors devised a strategy: they reduced the silver purity of the Denarius, supplementing it with cheaper, less valuable metals. This allowed them to mint more coins at a lower cost while maintaining the appearance of the coins' original value. Over time, this practice of increasing the money supply by diluting the silver content led to hyperinflation, severely impacting the Roman economy.

Although exact figures are elusive, economists and historians estimate that Rome experienced an inflation rate peaking at an astonishing 15,000% between AD 200 and 300. To put this into perspective, by AD 301, one Roman pound of gold was valued at a staggering 72,000 denarii coins, illustrating the severe devaluation of their currency due to rampant inflation. Needless to say, this was a contributing factor to the eventual fall of the Roman Empire.

It wasn’t just ancient Rome that experienced hyperinflation. Here is a graph provided by Investopedia of the worst cases of hyperinflation in recent times.