Where Your Tax Dollars Really Go: A Closer Look at War Spending

In today’s economic climate, it's becoming increasingly clear that defense and war spending in the U.S. is spiraling out of control, draining resources that could be used to improve the lives of everyday Americans. The Middle Class Party is focused on exposing and addressing these unchecked military expenditures, which funnel billions into weapons and defense contractors while neglecting critical domestic needs like healthcare, education, and infrastructure. With defense spending reaching staggering levels, it's time to question where our tax dollars are really going and how we can redirect them to benefit the middle class rather than fueling a never-ending cycle of war. In this post, we’ll break down the realities of the defense budget and why it’s time for a change.

Defense Spending

Did you know that a significant portion of your income taxes is being used to fund weapons and war? It’s a reality that many taxpayers aren’t aware of — and it’s not just pocket change we’re talking about. Last year, the average taxpayer contributed $5,009 of their income taxes to military expenses, with a staggering 35% of the typical tax bill going toward weapons and war. Corporations like Raytheon and Lockheed Martin, notorious for their roles in military production, enjoy enormous tax breaks. These breaks mean there’s less funding available for programs that benefit us all, such as education, healthcare, and infrastructure. And, while these corporations cash in on conflicts, the rest of us are left footing the bill for their profits.

The United States spent $820 billion on national defense during fiscal year (FY) 2023 according to the Office of Management and Budget, which amounted to 13 percent of federal spending. In 2023, defense spending was lower than the decade-long average of 15 percent of the federal budget. This reflects lawmakers' continued prioritization of national defense as a major budgetary focus. In fact, the United States allocates a larger share of its economy to defense than any other G7 nation (a group of the world’s largest advanced economies).

In FY2023, the overall defense budget amounted to $776 billion, with the vast majority allocated to the Department of Defense (DoD) for military operations. An additional $43 billion was directed to defense-related activities carried out by other agencies, such as the Department of Energy and the FBI.

DoD funding supported a wide range of military activities. The largest portion, $318 billion, went toward operation and maintenance, covering essential tasks like training, planning, equipment upkeep, and most of the military healthcare system (separate from the Department of Veterans Affairs' spending). Military personnel costs, the second-largest category, totaled $184 billion, which covered pay, benefits, and retirement for service members.

Several smaller categories made up the rest of DoD spending. Procurement of weapons and systems accounted for $142 billion, while $122 billion went to research and development for new military technologies. The military also invested over $10 billion in the construction and management of facilities, with $1 billion allocated to family housing.

War Spending by the Numbers

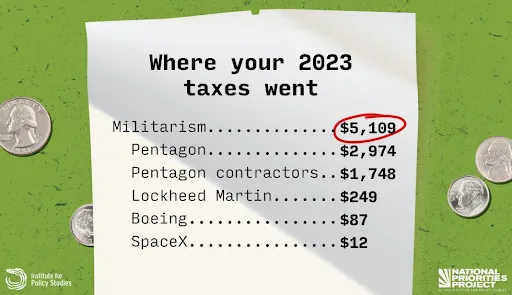

Let’s break it down. Last year, $2,974 of the average taxpayer's money went directly to weapons contractors, like Raytheon and Lockheed Martin. In contrast, you paid only $705 to cover service members’ pay and housing allowances, and a mere $11 on energy efficiency and renewable energy programs that could help combat climate change. Think about that: $11 to fight the climate crisis, compared to $249 that Lockheed Martin alone collected from each of us. To put that in perspective, that’s more than the average household spends on a week’s worth of groceries.

To put it in perspective, the Child Tax Credit program—responsible for nearly halving child poverty during its pandemic expansion—received just $110 per taxpayer. Meanwhile, weapons manufacturers continue to profit from inflated Pentagon spending, with $9 billion paid out in dividends to shareholders and stock buybacks in 2023 alone.

The following graphic is from the National Priorities Project at the Institute for Policy Studies and shows where your 2023 income taxes went, along with a fact sheet that breaks down the specific numbers:

Similarly, the average taxpayer contributes more to Pentagon contracts with Boeing ($87) than to the Federal Aviation Administration (FAA) ($23), the agency tasked with ensuring the safety of commercial air travel. This imbalance is particularly troubling, given Boeing’s recent history of safety failures—from planes crashing to parts breaking mid-flight.

You might also notice that SpaceX is on the list. In 2023, the average taxpayer paid $12 toward SpaceX contracts with NASA and the Pentagon—a small amount compared to other defense contractors, but still more than what’s spent on renewable energy and energy efficiency programs. At less than $11 per taxpayer for renewable energy, this figure highlights a glaring failure of public policy to address the root causes of climate change.

And it's not just our military benefiting from your tax dollars. In 2023, the average taxpayer contributed $112 to support foreign militaries. In contrast, only $58 went toward diplomacy efforts aimed at preventing and resolving conflicts. This stark imbalance highlights how much more is invested in fueling global militaries than in promoting peace.

It Isn’t Just You

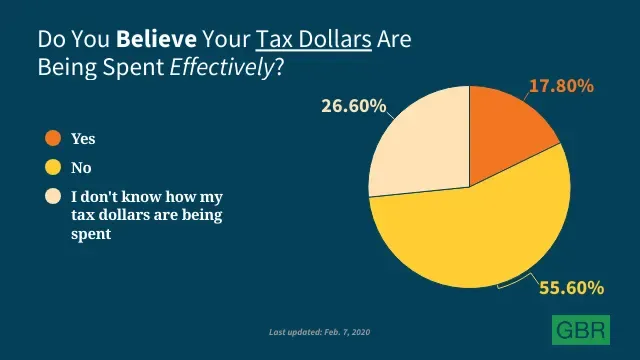

A survey by GOBankingRates polled 1,000 adults across the U.S. on their views about how tax dollars are being used. The results are telling: only 18% of respondents believe their tax dollars are being spent effectively, while nearly 27% admitted they have no idea where their money is going. These numbers highlight widespread uncertainty and dissatisfaction with current government spending, raising questions about transparency and accountability in how taxpayer money is allocated.

When asked what they didn’t want their tax dollars funding, one-third of respondents chose war as their top concern. This sentiment was consistent across all age groups and genders, making war the number one expenditure that Americans believe should not be supported by their taxes. This widespread opposition reflects growing discomfort with the nation's military spending priorities, highlighting a desire for funds to be allocated toward more peaceful and constructive purposes.

The Real Cost of Military Spending

The issue goes beyond just the dollars spent. The Pentagon’s unchecked budget — which is creeping toward $1 TRILLION for FY2025 — diverts resources from domestic priorities, like healthcare, education, and infrastructure.

As a result, crucial needs at home go unmet while we continue to fund a cycle of violence and instability both in the U.S. and abroad.

War spending doesn’t create lasting peace or security. When you invest in war, you get more war. By failing to prioritize diplomacy, humanitarian aid, and sustainable development, we’re missing the opportunity to build a more peaceful and just world. Instead, we’re pouring more money into bombs and bullets, fueling conflicts that often come back to haunt us in other ways.

A Different Way Forward

Imagine what could be accomplished if even a fraction of the billions spent on war and weapons was redirected toward the urgent needs of our communities. Increased funding for education, healthcare, and renewable energy would benefit everyone by creating jobs, improving quality of life, and addressing the pressing challenges of our time, like climate change.

The Middle Class Party believes that taxpayers should have a real say in how their hard-earned money is spent. It's time for a fundamental shift in priorities—away from endless war and military build-up, and toward investments that promote peace, well-being at home, and a sustainable future.

This isn’t just a financial issue; it’s a moral one. Our tax dollars should be working for us, building the future we want, not perpetuating the wars we don’t