Drunk Sailors: The Case for Prudent Government Spending in America

Throughout American history, frugality and careful financial stewardship have often been heralded as virtues not only for individuals but also for our government. This no longer seems to be the case as the U.S. government continues to spend wildly and recklessly, squandering the wealth of our nation. We need prudence in government spending and accountability. This article aims to dissect the necessity for prudent fiscal policies that secure the prosperity of our nation and safeguard the future of the middle class.

This article is brought to you by the Middle Class Party, committed to fostering a unified America grounded in practical solutions and mutual solidarity. Our mission is to bridge divisions and empower the everyday American. As part of our series dedicated to reinvigorating the ideals of our founding fathers, this piece seeks to honor their legacy by tackling modern challenges through informed, common-sense approaches.

How Government Spending Works

'Benjamin Franklin once remarked that “A penny saved is a penny earned.” But this once popular and common sense adage has given way to a pattern of spending that resembles the recklessness of a drunken sailor. The metaphor is stark but apt—just as a sailor on leave may squander his pay on short-lived pleasures, so too can a government, unchecked, drain the coffers of its people.

As of late April 2024, the government has already spent $3.25 trillion in fiscal year 2024 according to the U.S. Treasury. This is $103 billion more compared to the same time period last year.

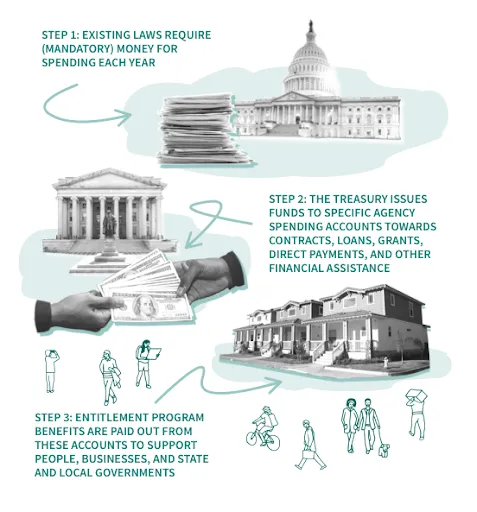

The spending is broken down between mandatory and discretionary spending. Mandatory spending represents nearly two-thirds of annual federal spending. This type of spending does not require an annual vote by Congress. The following chart shows how it works.

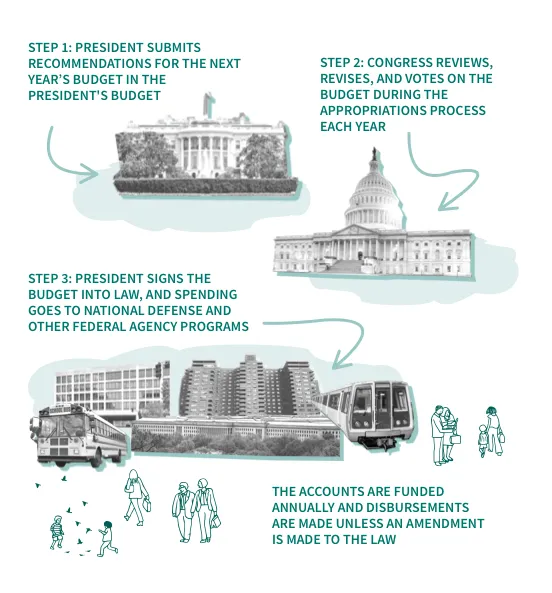

The second major category is discretionary spending. The difference between mandatory and discretionary spending relates to whether spending is dictated by prior law or voted on in the annual appropriations process. Again, this is illustrated by the following chart.

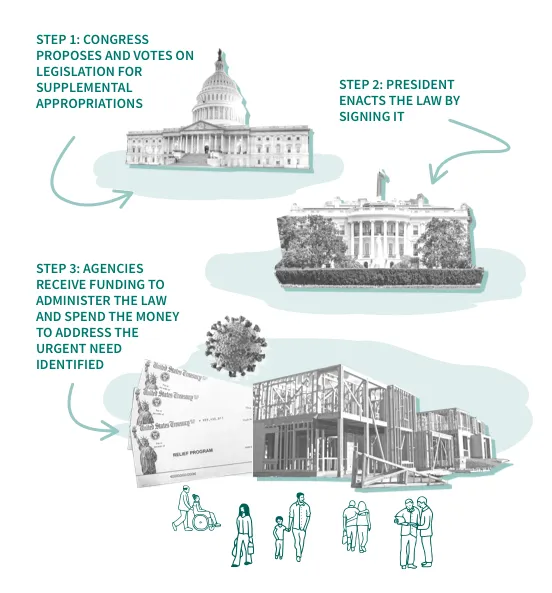

There is another type of discretionary spending called supplemental appropriations. This is where spending laws are passed to address needs that have arisen after the fiscal year has begun. These are often the result of national emergencies. For example, congress passed four supplemental appropriations to aid the nation’s recovery from the COVID-19 pandemic.

This isn’t too complicated to understand yet our elected public officials cannot grasp the basics, further driving the U.S. into debt.

The Current Debt

According to the Peter G. Peterson Foundation, the U.S. national debt is $34 trillion and rising. Broken down, that is $102,741 for every single person in the country.

Why is this the case?

There is a mismatch between spending and revenues.

Our nation's deficits stem from clear, structural factors: the advancing age of the baby-boom generation, ever-increasing healthcare expenses, and a tax system that fails to gather the necessary funds to uphold the promises our government has made to its people.

An Ageing Population

Every day, 10,000 baby boomers will turn 65. This is projected to continue through 2030, putting a strain on the federal budget as the government struggles to continue to fund Social Security, Medicare, and Medicaid.

Increased Healthcare Costs

Healthcare represents nearly one-fifth of our entire economy, and it is the second fastest-growing part of the budget. The U.S. healthcare system is the costliest worldwide, yet the return on our investment is disappointingly low. We expend more than twice as much on healthcare compared to other advanced nations, yet our outcomes do not reflect this spending

Insufficient Revenue

The U.S. does not generate enough revenue to cover the wild spending nor fulfill the promises of our policymakers. In 2023, the U.S. brought in $4.4 trillion in revenue. However, they spent $6.1 trillion. Because we are in a deficit, the government must borrow more and more money, leading to the interest compounding.

Every day the U.S. spends $2.4 BILLION on interest.

This puts a strain on our economy, both today and tomorrow. Interest is quickly becoming the fastest growing part of the federal budget.

Wasteful Spending

Did you know that the government also wastes billions of taxpayer money?

Not on spending bills or programs.

Not on research and development.

Not serving their constituents.

But simple waste.

Oversight reports from nonprofits and legislators, including Senator Rand Paul of Kentucky, highlight that billions of dollars are wasted annually. Examples include $1.7 billion spent on maintaining empty government buildings and an erroneous $28 million expenditure on forest camouflage uniforms intended for use in the deserts of Afghanistan. These funds could instead bolster vital areas such as our faltering education system and deteriorating infrastructure.

But it gets worse.

According to the Government Accountability Office (GAO), improper payments—those made in error by the government—amounted to $247 billion in 2022 alone. Over the past two decades, these simple payment errors have resulted in nearly $2.4 trillion in losses for the U.S. government, as per GAO estimates.

In another instance, 99% of the $837 billion allocated for economic stimulus checks during the pandemic successfully reached taxpayers. However, the 1% failure rate meant that nearly $8 billion was erroneously disbursed to "ineligible individuals."

It is so bad that congressman Bill Posey has his own Wasteful Spending List, which is highly detailed. A few examples include:

Tax Dollars for Phantom Grants: The government pays as much as $2 million annually in monthly services fees to maintain about 28,000 phantom grant accounts that are empty and have expired.

Bonuses for Employees Being Investigated for Misconduct: Since 2008 the GSA has given more than $1 million in bonuses to employees being investigated for misconduct.

Hundreds of DC City Workers Receiving Nearly $2 Million in Fraudulent Unemployment Benefits: Nearly $1.9 million was overpaid to District workers who collected unemployment benefits while on the city's payroll.

Government Funds to Buy Typewriters and Other Outdated Products: For years, the General Services Administration (GSA) has been awarding contracts of nearly $24 million to thousands of companies for outdated products. This includes commemorative items, photographic equipment, and typewriters.

This is just the tip of the wasteful spending iceberg. As the average American suffers from inflation and the reality that the American Dream is becoming increasingly out of reach, the government continues to make ridiculous spending choices. Here are some additional examples from the Foundation for Economic Education:

$38 Million to Dead People: According to a special task force assigned to monitor COVID-related federal payments, $38 million was mistakenly sent to individuals already dead in 2023. Even more horrifying, $1.3 million of this amount was distributed to 30 individuals who had been dead for at least a year.

$6 Million to Increase Egyptian Tourism: The U.S. allocates significant funds to foreign aid, supporting a variety of humanitarian, social, and security initiatives. But also apparently on tourism programs as well. This was part of a larger sum of $100 million spent on Egyptian tourism so far.

$200 Million to Famous Music Artists from the ‘Small Business’ Administration: Through the Shuttered Venue Operators Grant program, the Small Business Administration (SBA) allocated $200 million intended to support small entertainment businesses affected by pandemic shutdowns. Contrary to the program's purpose, a significant portion of these funds was disbursed to high-profile entertainers such as Post Malone, Lil Wayne, Chris Brown, and Smashing Pumpkins, each receiving up to $10 million.

Stolen Funds

It isn’t just government mismanagement of funds that hurts the average American, but also the graft and theft associated with government programs. According to the Associated Press, fraudsters potentially stole more than $280 billion in COVID-19 relief funding. This was in addition to the $123 billion was wasted or misspent. Combined, the loss represents 10% of the $4.2 trillion the U.S. government has so far disbursed in COVID relief aid.

How did this happen?

In the rush to distribute funds, critical safeguards meant to protect federal money were neglected. Prospective borrowers were permitted to "self-certify" the accuracy of their loan applications, a significant relaxation of standard protocols. This lapse in government oversight enabled thousands of individuals, who would normally have been disqualified, to fraudulently receive funds they were not entitled to. This includes debarred contractors, fugitives, felons or people convicted of tax fraud.

Why It Matters

The growing debt harms our country and our population. America faces many challenges. Every dollar spent on paying our enormous interest is a dollar that could have been spent strengthening our country. Future generations will inherit this debt and a country that will be less prosperous and less competitive on the world stage. This is precisely why we need a renewed commitment to prudent policy-making that ensures our fiscal health while honoring our obligations to all Americans.

We Need Financial Prudence

We need prudence, not for the sake of austerity but for balance and foresight. These are required for any democracy to thrive. Adhering to prudent spending ensures that government programs are both sustainable and effective, targeting areas where they can do the most good such as education, infrastructure, and health care, without compromising the financial integrity of the nation.

Furthermore, prudent spending can prevent economic disparities from widening. By carefully planning and allocating resources, the government can enhance its support for the middle class, the backbone of the American economy, thereby ensuring that prosperity is a shared experience, not reserved for a select few.

Steps Toward Financial Prudence

The path to fiscal prudence involves several key steps:

Budgetary Reform: Implementing strict budgetary controls and frameworks that align government spending with realistic revenue projections.

Debt Management: Establishing clearer strategies for debt reduction, including more effective management of public assets and liabilities.

Efficiency Audits: Conducting regular audits of government programs to eliminate waste, fraud, and abuse, ensuring that taxpayer money is spent effectively.

Long-Term Planning: Focusing on long-term investments rather than short-term fixes, which can often be more costly in the end.

Public Engagement: Encouraging public participation in budget discussions to increase transparency and trust in government spending decisions.

Accountability: Insuring that our politicians are accountable for government spending decisions.

We Need You

As members of the Middle Class Party and concerned citizens, our role is not merely to critique but to advocate for change. It is our duty to hold our leaders accountable, to demand transparency and prudence in how our resources are managed. By doing so, we honor the legacy of our forebears who entrusted us with the stewardship of a great nation.

The case for prudent government spending is clear. It is not about diminishing the government's role but enhancing its effectiveness and ensuring that it serves the common good. As we stand at this fiscal crossroads, let us choose the path of responsibility and foresight, for the sake of our present and the future generations of Americans.

Join Us

If you are tired of government spending that falls short of addressing the real challenges faced by everyday Americans, join us in making a change. The Middle Class Party is committed to a platform rooted in practicality, offering policies designed to empower Americans and strengthen our nation's resilience. Let’s work together to ensure our government acts with the effectiveness and efficiency that our citizens deserve.